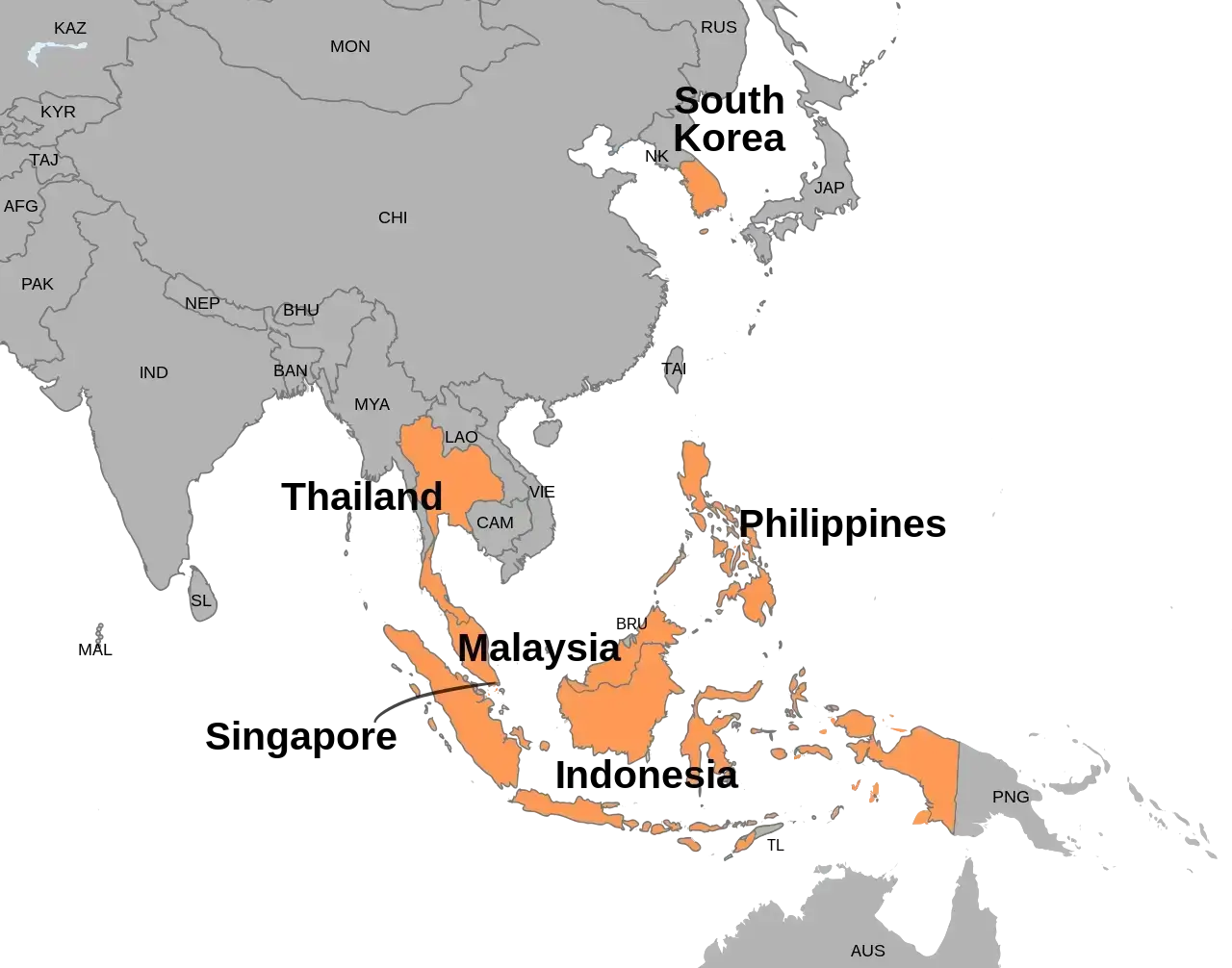

The 1997 economic crisis, also known as the Asian financial crisis, was a severe economic turmoil that affected several countries in the Asia-Pacific region, including Thailand, Indonesia, South Korea, and Malaysia. The crisis began in July 1997 and lasted for several years, causing significant economic and social disruption in the affected countries. This article will discuss the causes, effects, and responses to the 1997 economic crisis.

Table of Contents:

Understand economic events better with a demo account

Background and Context

The Asia-Pacific region experienced rapid economic growth in the years leading up to the crisis, with many countries adopting market-oriented economic policies and attracting foreign investment. However, this growth was built on financial deregulation and unsustainable lending practices, which would ultimately contribute to the crisis. In addition, the region was highly dependent on exports, particularly to the United States, which made it vulnerable to changes in the global economy.

1997 Asian financial crisis. (2023, February 16). In Wikipedia.

6 reasons for the crisis

The economic crisis of 1997 was caused by a combination of factors:

Macroeconomic imbalances, including a large current account deficit

Many of the countries affected by the crisis, such as Thailand, Indonesia and South Korea, ran large current account deficits, which occur when a country imports more goods and services than it exports. This deficit led to a loss of confidence among foreign investors, which in turn led to a crisis in Asian currencies.

Exports become less competitive due to overvalued currencies.

In the run-up to the crisis, many affected countries had overvalued currencies, making their exports more expensive and less competitive in global markets. This reduced demand for their goods and services and weakened their economies.

Unsustainable lending practices

Many affected countries have been borrowing heavily from foreign lenders in the form of short-term debt, which is risky and can lead to liquidity problems, especially if funds are suddenly withdrawn by foreign investors.

Reliance on exports, especially to the United States

Many of the affected countries depend heavily on exports, particularly to the United States. When demand for their exports fell, their economies suffered.

Withdrawal of foreign funds resulting in a shortage of liquidity

As the crisis spread, foreign investors began to withdraw their funds from the affected countries, leading to a liquidity shortage that caused difficulties for banks and other financial institutions.

sharp devaluation of currencies

As the crisis worsened, many affected countries were forced to devalue their currencies to remain competitive. This led to higher inflation and interest rates, making it difficult for companies and households to repay their debts and leading to a collapse in asset prices, particularly in real estate and stock markets, thus further weakening the economies of affected countries.

9 Effects of the Crisis

The 1997 economic crisis had a profound impact on the affected countries, with severe economic, social and political consequences.

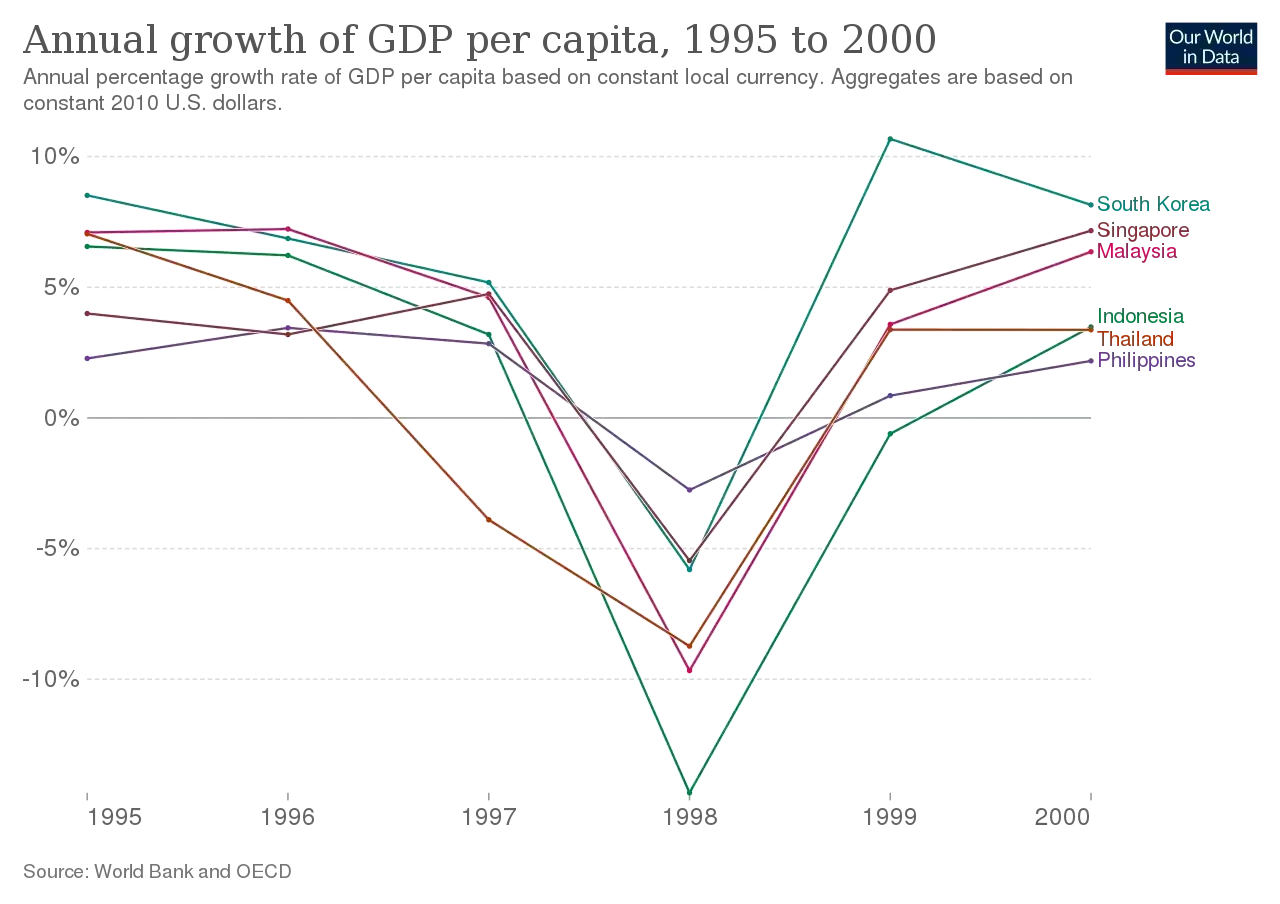

Sharp economic contraction and recession in affected countries

The crisis led to a sharp contraction in the economies of many affected countries, resulting in a recession that lasted for several years. Its consequences included widespread job losses and a decline in economic activity.

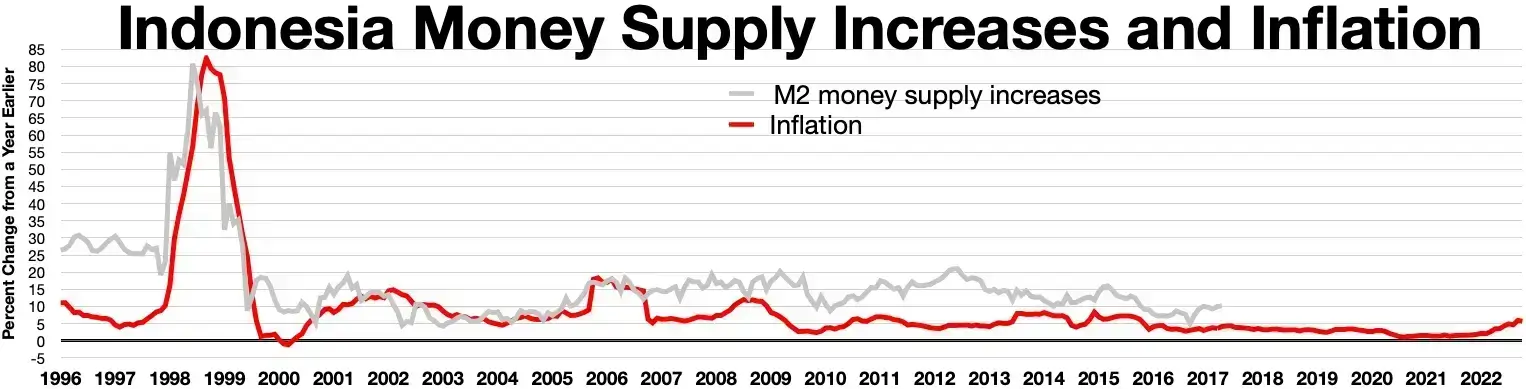

currency devaluation and inflation

The sharp decline in the value of currencies in many affected countries has led to high inflation, making it difficult for businesses and households to afford basic goods and services.

1997 Asian financial crisis. (2023, February 16). In Wikipedia.

Financial sector instability and banking crises

The crisis led to a wave of instability in the financial and banking sector, with many banks and financial institutions exposed to the risks of the crisis. This led to the collapse of many financial institutions and forced many others to recapitalize or be rescued by governments.

Business bankruptcy and job loss

Many companies were unable to pay their debts and declared bankruptcy, resulting in job losses and a decline in economic activity. This had a major impact on many industries, especially those that depend heavily on exports.

social and political unrest

The crisis has led to social and political unrest in many of the affected countries, as people have become increasingly frustrated with the economic situation and the perceived failure of their governments to address the crisis.

1997 Asian financial crisis. (2023, February 16). In Wikipedia.

Loss of investor confidence and capital flight

The crisis has led to a loss of investor confidence in many affected countries, leading to capital flight and reduced investment in affected economies.

Spillover effects on other emerging market economies

The crisis had spillover effects on other emerging market economies, particularly those with similar economic structures and vulnerabilities.

Demands for reform of international financial institutions and policies

The crisis has led to calls for reform of international financial institutions and policies, particularly in the areas of financial regulation, exchange rate policy and debt management.

Raising awareness of the risks of globalization and financial liberalization

The crisis has heightened awareness of the risks of globalization and financial liberalization, particularly in emerging market economies. This has led to a reassessment of economic policies and increased scrutiny of the risks associated with global economic integration.

8 Responses to the Crisis

Many affected countries have implemented different policies, including:

IMF Assistance

The IMF has provided financial assistance to many affected countries to stabilize their economies and support reforms.

Exchange rate adjustments

Many affected countries have adjusted exchange rates to restore competitiveness and reduce the risk of currency crises.

Banking sector reforms

Many affected countries have implemented reforms to strengthen their banking sectors and improve regulation and supervision.

Adjusting public finances

Many affected countries have implemented measures to reduce their budget deficits and improve their financial positions to restore investor confidence and reduce the risk of future crises.

1997 Asian financial crisis. (2023, February 16). In Wikipedia.

debt restructuring

Many affected countries have undertaken debt restructuring efforts to reduce their debt burdens and make their debt more sustainable.

Easing and liberalizing trade

Some affected countries have implemented trade liberalization measures to improve their competitiveness and boost economic growth.

Calls for improved international cooperation and coordination

The crisis called for greater international cooperation and coordination to better manage financial risks and promote economic stability.

Public protests and social movements

The crisis has also led to public protests and social movements in many affected countries, with people demanding more accountability and fairer economic policies.

in conclusion

The 1997 economic crisis was a significant event in the history of the global economy and financial system. While the immediate impact of the crisis was severe, many of the affected countries have since recovered and become important players in the global economy. However, the crisis also left a lasting legacy, particularly with regard to the importance of financial regulation and the need to address macroeconomic imbalances.

Understand economic events better with a demo account

Are you looking to better understand how economic events impact the financial markets? Open a demo account today and gain practical experience without risking any of your hard-earned money. ATFX offers all major financial products on a powerful trading platform to practice

different strategies while continuing to learn from a guide or from the free training materials provided by ATFX. So, get your demo trading account for free now!